How to create a more equal society

-

Research

- Justice and Equality

Posted on 14 April 2016

James Meade, one of the leading economists of the twentieth century, believed public wealth could fund a fairer society - an idea worth revisiting, says Dr Martin O'Neill in our Department of Politics.

In the UK we have missed the opportunity to use public wealth as a driver for realising a more equal society”

Britain frittered away the financial benefits of North Sea oil under the then Chancellor Nigel Lawson, while the Norwegian government used its oil bonanza to finance a sovereign wealth fund that is now one of the largest in the world.

The difference between the two approaches is highlighted by political philosopher Dr Martin O’Neill, who is studying innovative ways in which the growing and widening inequalities in modern capitalist societies might be reduced. His research is also looking at how a society based upon social justice and equality might emerge and develop.

Missed opportunity

“The contrast between the Norwegian and the UK approach to the oil bonanza is telling,” says Dr O’Neill from our Department of Politics. “In Norway we can see how the benefits of capitalism can be more widely shared while in the UK we have missed the opportunity to use public wealth as a driver for realising a more equal society."

His recent project, funded by the Independent Social Research Foundation (ISRF), sees him exploring the work of James Meade, a neglected, but much admired, British economist, whose work has influenced a number of currently fashionable thinkers, including the French economist Thomas Piketty.

“I’m investigating how economists and political philosophers can learn from one another, when it comes to grappling with the big, fundamental questions of inequality and social justice,” he says.

“We need to find solutions to these problems, solutions that capture the popular imagination and that can win public support. And we need to tackle inequality in a way that allows the economy to prosper and grow. I believe that Meade provides us with a route towards those solutions, and that thinkers such as Piketty are following in his footsteps.”

Dr O'Neill's work on wealth sharing featured in our research showcase YorkTalks 2016

Democratic wealth

Alongside the dispersal of private property in what he called a ‘property owning democracy’ Meade charted a course towards the creation of collective, democratic wealth.

“Meade envisaged the creation of public institutions akin to the sovereign wealth funds that have come to play an increasingly important role in the world economy," Dr O’Neill says.

“These include the Alaskan Permanent Fund or, most impressively, the Norwegian Statens Pensjonsfond Utland (SPU), a collective investment vehicle that owns roughly one per cent of global equities.

“Such forms of public and democratic wealth ownership could be used to fund a citizens’ income, as in the Alaskan case, or in any other democratically authorised way. This would allow the socialisation of increasing returns to capital, while decoupling individual life-chances from excessive dependence on outcomes in the labour market.”

This research was funded by the Independent Social Research Foundation (ISRF)

The text of this article is licensed under a Creative Commons Licence. You're free to republish it, as long as you link back to this page and credit us.

Dr Martin O'Neill

Research interests in contemporary political philosophy, especially equality, liberty, responsibility and social justice

Discover the details

Dr O’Neill’s chapter 'Creating a More Equal Future', which discusses a number of institutional proposals such as the creation of a British sovereign wealth fund, features in a Fabian Society book, Future Left, edited by Andrew Harrop and Ed Wallis

Read Dr O'Neill's discussion of 'Piketty, Meade and Predistribution', part of a book symposium on Thomas Piketty’s Capital in the Twenty-First Century

Read the response from Professor Piketty: Capital, Predistribution and Redistribution

Dr O'Neill's article: If Cameron wants a property owning democracy, he has to support the mansion tax was published in The Conversation

Explore more research

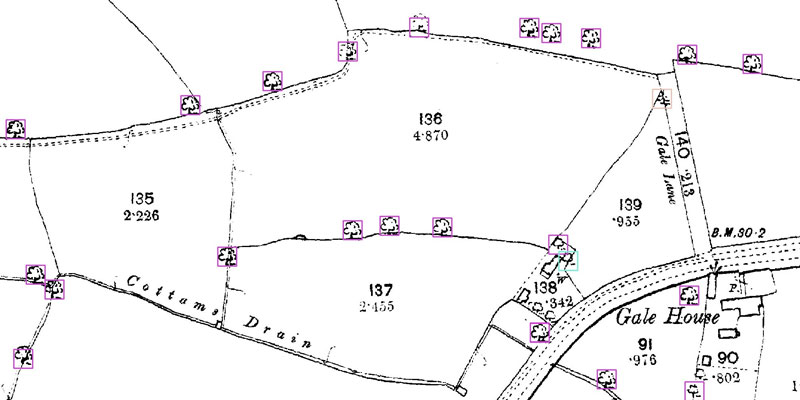

A research project needed to spot trees on historic ordnance survey maps, so colleagues in computer science found a solution.

We’re using gaming technology to ensure prospective teachers are fully prepared for their careers.

A low cost, high-accuracy device, could play a large part in the NHS's 'virtual wards'.