Tax could cut consumption of sugary cereals and drinks

-

Research

- Health and Wellbeing

Posted on 20 June 2016

Research shows a sugar tax could steer us towards healthier eating

...a tax on sugary drinks and unhealthier breakfast cereals could influence consumer behaviour. It also shows the benefit of telling shoppers how much tax they are paying – this seems to act as an additional ‘nudge’ away from some of the unhealthier choices we offered them.

A 20 per cent sugar tax could discourage shoppers from buying unhealthier breakfast cereals, research involving health economists at York has shown.

And if shoppers are told about the amount of tax they are paying it gives them an extra ‘nudge’ towards healthier alternatives.

Shopping habits

The research studied the shopping habits of 1,000 people across the UK who were each given a budget of £10 to spend on soft drinks and cereals. They were asked to choose products from a purpose-built online website designed to resemble major supermarket sites.

The researchers wanted to compare the effect of a 20 per cent and 40 per cent tax on unhealthier cereals and soft drinks. They also wanted to know if telling people the products were being taxed made a difference to their cereal and drink choices.

They found that a 20 per cent tax was enough to influence spending decisions, especially if shoppers knew how much tax they were paying.

The research showed:

- A 40 per cent tax reduced the purchase of both unhealthier cereals and sugary soft drinks

- A 20 per cent tax significantly reduced the sale of cereals, but not of the sweetened drinks

- If shoppers knew they were being taxed by 20 per cent, purchases of both sets of products fell by around half.

“Our research shows that a tax on sugary drinks and unhealthier breakfast cereals could influence consumer behaviour,” said Professor Marc Suhrcke from our Centre for Health Economics. “It also shows the benefit of telling shoppers how much tax they are paying – this seems to act as an additional ‘nudge’ away from some of the unhealthier choices we offered them.”

The research was carried out in close collaboration with experts from Newcastle University, who led the work, and Anglia Ruskin University.

Supermarket website

Shoppers were asked to complete ten tasks on the modified supermarket website. Five of the tasks were to buy cereals and the other five were to buy sugar sweetened drinks. The shoppers could also choose not to buy.

Soft drinks are to be taxed by the UK Government from 2018 in a bid to tackle obesity and rising levels of diabetes. The tax, announced in the March 2016 Budget, means that drinks companies will be taxed according to the amount of sugar in the products they produce or import.

The research was funded by the Department of Health Policy Research Programme

The text of this article is licensed under a Creative Commons Licence. You're free to republish it, as long as you link back to this page and credit us.

Professor Marc Suhrcke

Research interests in economic and econometric aspects of public health in low and middle income countries

Dr Ryota Nakamura

Research interests in empirical and theoretical investigations of health related behaviour and healthcare systems

Discover the details

The impact of taxation and signposting on diet: an online field study with breakfast cereals and soft drinks is published by the University of York’s Centre for Health Economics

This report is independent research funded by the Department of Health Policy Research Programme (Policy Research Unit in Behaviour and Health (PR-UN-0409-10109)).The views expressed in this publication are those of the authors and not necessarily those of the Department of Health.

Researchers in the Centre for Health Economics are also studying the impact of the tax on sugary drinks in Chile. This work is funded by the Newton Fund

Explore more research

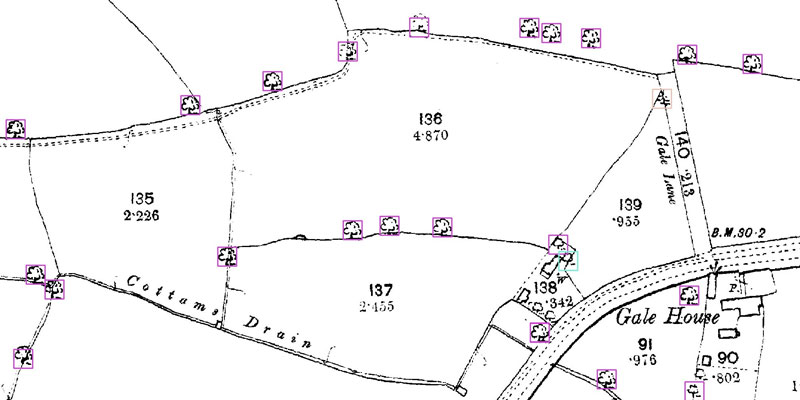

A research project needed to spot trees on historic ordnance survey maps, so colleagues in computer science found a solution.

We’re using gaming technology to ensure prospective teachers are fully prepared for their careers.

A low cost, high-accuracy device, could play a large part in the NHS's 'virtual wards'.