State-backed businesses cost Britain billions

Posted on 23 July 2015

Our research shows that private businesses are relying heavily on the state and that Britain’s ‘free’ market economy is actually costing over £93bn.

A full debate about the ways in which corporate welfare is funded and delivered is long overdue”

The report, by Dr Kevin Farnsworth from the School for Business and Society, examines the extent of corporate welfare - the various ways in which governments service the needs of business. The study also estimates the potential cost or value of the various forms of public provision for private businesses.

State-backed business

Using 2012/2013 as a snapshot year, Dr Farnsworth estimates that subsidies, capital grants, tax benefits, insurance and advocacy as well as transport, energy and procurement subsidies cost Britain around £93bn per year.

He argues that our government directly and indirectly supports business activities and minimises the risks companies would otherwise face.

“Businesses depend on a good legal system, state-backed currency and financial system, in addition to grants and subsidies that help to support investment, growth, research and development and marketing and sales,” explains Dr Farnsworth.

Costs

In his report, he shows that businesses also extract value out of a range of other ‘public' services, including in-work benefits and the education and health services, which adds another £52bn. Lastly, the legacy costs of the 2008 bank bailouts and the ongoing ‘too-big-to-fail’ subsidy to banks are together worth around £35bn per year.

“The net effect of these ‘public’ services is to effectively spread the risks and costs that would otherwise be borne by private businesses,” says Dr Farnsworth.

“The costs are huge, but they are also obscured and largely absent from the public agenda. However, even if we include in the focus only direct subsidies and grants to private companies as the minimum core corporate benefits, we would have a figure that is far higher than the UK Government spends on Job Seekers Allowance.”

Debate

The research emphasises the fact that it is difficult to arrive at a final estimate on costs and does not argue that it is desirable to simply cut corporate welfare. Rather, the findings seek to place the needs of corporations at the heart of the current debate about the state.

“Corporate welfare has always been with us,” explains Dr Farnsworth,“but during these times of austerity it is important to scrutinise the benefits that accrue to private businesses and ask questions about how to ensure that corporate welfare works in the wider public interest. It is also important to ensure that the recipients of corporate welfare contribute fully to its costs and do not undermine the very public services upon which they depend.”

Alongside the report, a new searchable database of subsidies and grants to individual companies has been launched at www.corporate-welfare-watch.org.uk, with the help of funding from the Joseph Rowntree Charitable Trust.

So what’s next?

“A full debate about the ways in which corporate welfare is funded and delivered is long overdue,” says Dr Farnsworth.

“Such a debate is hindered, however, by the fact that corporate welfare is, with very few exceptions, rarely acknowledged and discussed. This report and database seeks to reverse that.”

The text of this article is licensed under a Creative Commons Licence. You're free to republish it, as long as you link back to this page and credit us.

Dr Kevin Farnsworth

Research interests in political economy of welfare states, corporate welfare, welfare states and economic crisis, and the power and influence of business on policy

Find out more

- Full report: The British Corporate Welfare State

- Corporate Welfare Watch Database

- The research featured in this front page story in The Guardian. Read further coverage

- Dr Kevin Farnsworth also wrote an opinion piece in the Comment is Free section of The Guardian

Visit the School

Explore more research

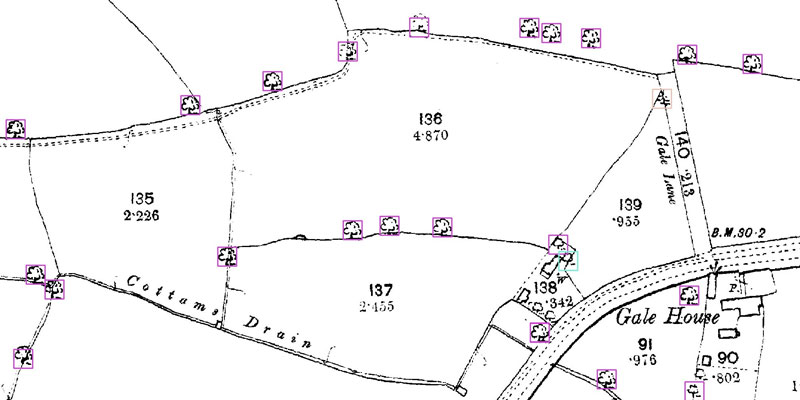

A research project needed to spot trees on historic ordnance survey maps, so colleagues in computer science found a solution.

We’re using gaming technology to ensure prospective teachers are fully prepared for their careers.

A low cost, high-accuracy device, could play a large part in the NHS's 'virtual wards'.