Why big business needs to work for the many not the few

-

Research

- Justice and Equality

Posted on 9 September 2016

In an age of corporate greed and tax avoidance, one of our leading business law experts is researching the case for a more socially responsible company culture.

The belief that the success of investors is socially and economically desirable seems unshakeable. But it must be shaken”

The UK Government is planning big reforms for big business. Proposals to cut executive pay and tackle tax avoidance are expected later this year. And Prime Minister Theresa May wants a bigger role for workers in the boardroom.

But after decades of monetary policies which have widened the gulf between bosses and their workers, what are the chances of a more socially responsible business model? And what could that brave new corporation look like?

Professor Lorraine Talbot, a company law specialist from our Law School, is mid-way through a two-year Leverhulme Trust-funded project looking at how to make companies fit to meet social purposes.

She says serious reform of the UK business landscape will require a “rebalancing” of the relationship between labour and capital. And she thinks that in the vacuum of ideas which followed the Brexit vote, reform may become possible.

“The belief that the success of investors is socially and economically desirable seems unshakeable. But it must be shaken. The Brexit vote showed there is an appetite for wealth to be shared more widely."

“What is good for corporate investors is seen as successful business, but it is bad for labour - and because most of the world’s population falls into the latter category, inequalities abound."

Her research underlines how businesses, their owners and shareholders have flourished under Government policies which have driven massive increases in personal corporate wealth, often at the expense of their workforce.

Super-rich

With the help of case studies based on UK-based multinational companies, she highlights how the growth of capital, rather than support for employees has helped to create a class of the super-rich, the super-poor and a diminishing middle class.

At the heart of her work, is the belief that the market cannot be the mechanism to ease inequality - because it is the market itself that creates the inequality.

“When the market is prosperous, it is doing so because the capital it creates is successfully capturing the value of goods and services created by the workforce.”

Free market

Professor Talbot says the neoliberal belief that corporate wealth would ‘trickle down’ from the free market has never happened.

“Profit isn’t shared,” she says. “Profit is claimed by business owners or by shareholders, causing inequalities in wealth and income. Shareholders and executives have benefited from loose monetary policy, but the majority of employees have not.”

The introduction of tax credits and the living wage have failed to narrow the income gap between executives and their workforce.

And the availability of cheap labour in sweat shop factories across the world has made inequality a global issue.

So how can we re-draw the corporate balance sheet? How can businesses work for the many not the few?

Shareholders

Professor Talbot says reforms should include curtailing the power and influence of shareholders while carving out a bigger role for employees.

“Representatives from the workforce must be involved in all significant decisions relating to the company including substantial property transactions, restructuring, takeovers and director remuneration.

“Currently company law empowers shareholders to dictate how production is organised in society, but imposes no fiduciary duties upon them to act in the best interests of the company. Reforms are essential to protect the UK productive capacity and to ensure workers are paid for the contributions they make.”

The rules on takeovers also need to be tightened up so that companies can fight off unwelcome bids and protect their productivity.

“At the moment, takeovers are viewed as a matter for shareholders alone, but they have significant impacts across a business, often leading to redundancies. Employees should have a bigger say in any negotiations.”

Alternative vision

The study sets out an alternative vision with a bigger role for employees: “The research looks at the role for companies which have ceased to make sufficient profits but still have a social function. It shows that they could continue by devolving ownership to the workforce – and why that is morally defensible.”

Professor Talbot says Brexit - and the appointment of a new Prime Minister - could force a rethink.

“The shock of Brexit could be an opportunity to make society fairer. This means reshaping the way that businesses are run to benefit not just their shareholders, but all employees and wider society.”

This research, Making the Company Fit for Social Purpose, is funded by the Leverhulme Trust

The text of this article is licensed under a Creative Commons Licence. You're free to republish it, as long as you link back to this page and credit us.

Professor Lorraine Talbot

Research interests in the tension between labour and capital and how companies might become a force for social progress

Discover the details

Five business reforms to make Brexit Britain a fairer society was published in The Conversation

Will the new national living wage hurt business? was published in The Conversation

How running companies for shareholders drives scandals like BHS was published in The Conversation

Visit the department

Explore the work of York Law School

Explore more research

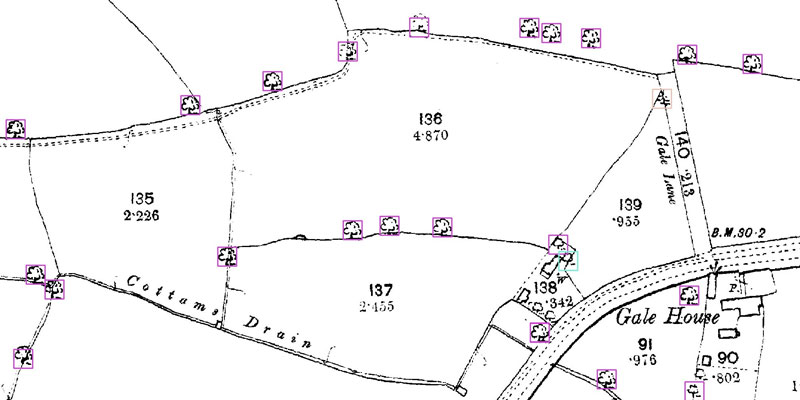

A research project needed to spot trees on historic ordnance survey maps, so colleagues in computer science found a solution.

We’re using gaming technology to ensure prospective teachers are fully prepared for their careers.

A low cost, high-accuracy device, could play a large part in the NHS's 'virtual wards'.